Quantitative Research: The financial crisis of 2007-08, also termed as “the Great Recession” replaced inflation with financial stability as chief concern for the Federal Reserve, in August of 2007. There are different views on the core causes of such crises which go back much further, however there is a general consensus among different policymakers, academics and other stakeholders that the relaxation in U.S mortgage lending credit standards and increasing rates of foreclosures adversely affected a wide range of U.S financial institutions. Further the policy of U.S government to encourage home ownership, coupled with the development of new types of complex securities such as adjustable mortgages and subprime loans allowed borrowers, who would otherwise be disqualified, to obtain generous home loans on the anticipation that housing prices would continue to rise indefinitely and that the interest rates would be kept low.

1. Introduction

1.1. Background of the Study

The financial crisis of 2007-08, also termed as “the Great Recession” replaced inflation with financial stability as chief concern for the Federal Reserve, in August of 2007.

There are different views on the core causes of such crises which go back much further, however there is a general consensus among different policymakers, academics and other stakeholders that the relaxation in U.S mortgage lending credit standards and increasing rates of foreclosures adversely affected a wide range of U.S financial institutions.

Further the policy of U.S government to encourage home ownership, coupled with the development of new types of complex securities such as adjustable mortgages and subprime loans allowed borrowers, who would otherwise be disqualified, to obtain generous home loans on the anticipation that housing prices would continue to rise indefinitely and that the interest rates would be kept low.

1.2. Problem Statement

The financial crisis of 2007-08 is considered as the most severe recession after the great depression of 1930’s in the U.S.

This creates a need to identify and analyze the factors which contributed to the financial crisis of 2007-08 with the objective of proactively identifying and responding to any variables in the future economy which might lead to another financial meltdown.

1.3. Research Gap

Numerous research has been conducted on various dimensions of financial crisis of 2007-08, such as the factors responsible, consequences and policy responses to the crises, using techniques mostly involving post-crisis interviews and behavioral analysis.

However there exist a gap in analyzing the various factors responsible for the financial crisis of 2007-08 on the basis of indicative quantitative data existing prior to the financial meltdown.

1.4. Research Questions

- To what extent were the long-term developments in financial market to blame for the financial crisis?

- Did derivatives and other financial risk management techniques actually increase the risk of economic instability?

- Was the market performance too much reliant on computer models?

- Did regulators and policy makers fail to prevent excessive risk taking or their jurisdiction was too limited?

- Did government policies and actions inadvertently became the basis for different preconditions of financial crisis?

1.5. Research Objective

The objective of this research is to analyze the main factors which were responsible for the financial crisis of 2007-08.

1.6. Limitations of the Study

The main limitations to this study include the availability of sufficient time and funds to conduct further research.

Such further research would have involved cross sectional research or time series analysis, using greater number of observations with the objective of performing comparative analysis of the factors responsible for the financial crisis of 2007-08.

1.7. Organization of Structure

The research report is structured in a logical manner which initiates with a literature review shedding light on the theoretical aspect of existing literature, for the purpose of providing a framework for research.

The literature review is followed by an explanation of the research methodology adopted and findings of the research.

In the end conclusions are drawn and recommendations provided on the basis of research findings, along with the identification of scope for future research.

2. Literature Review

2.1. Theoretical Background

The term “Great Recession” is used in place of the “Great Depression” of the 1930’s, primarily because during the depression of 1930’s the GDP declined approximately by more than 10 percent and the unemployment rate peaked at 25 percent, however during the economic downturn of 2007-08, which is considered as the most severe downturn in the intervening years, the United States GDP declined by around 0.3 percent and 2.8 percent in 2008 and 2009 respectively, and the unemployment at one point peaked at 10 percent.

In the wake of 2001 recession coupled with the 11/09/2001 attack on the World Trade Center, the United States Federal Reserve pushed the interest rates to the lowest levels with the objective of maintaining economic stability.

However from 2004 the Federal Reserve started to increase the rate of interest for keeping the inflation in check, which led to the resetting of existing adjustable mortgages at much higher rates than the borrowers had anticipated or were led to expect, thereby creating the housing bubble.

During American housing boom the United States financial institutions began marketing at unprecedented levels, of mortgaged-backed securities and complex derivatives.

When the housing market collapsed in 2007 the financial institutions that had financed the housing bubble followed the same downturn.

This proved to be a breaking point for many over-leveraged investment banks and led to the collapse of some of the largest U.S investment banks having a positive credit rating, including the collapse of Bear Stearns and Lehman Brothers in March 2008 and September 2008 respectively.

After this the contagion quickly spread across the globe, affecting European economies the greatest.

As a result of this recession the American household lost around $19 trillion as a result of stock plunge and more than 8.7 million jobs causing the unemployment rate to double.

2.2. Empirical Studies

2.2.1. United States Studies

Different policy makers and academics have different views regarding the causes of the financial crisis of 2007-08 and the inability of techniques applied to deal with economic crises of earlier periods.

Some blame the government for ineffective and inefficient regulations whereas other blame the financial institutions.

However there is general consensus among all stakeholders regarding the following causes of the financial crisis of 2007-08.

Imprudence and Lack of Transparency in Mortgage Lending: In addition to low interest rates and rising prices of houses, relaxations in mortgage lending allowed people to buy houses they could not afford otherwise, on a presumption that the housing prices could only go up. However bad signs for the U.S financial system arose when the housing prices started to decline in mid-2006 and the loans started going bad. It is estimated that at its peak the sub-prime loans were only $1.5 trillion in relation to the overall U.S mortgage market of $11 trillion and total debt outstanding of $50 trillion.

Furthermore many participants of the housing finance value chain played their role in the creation of bad mortgages and selling of bad securities with the objective of making more money and premise that they would not be held accountable.

Due to such non-accountability and lack of fear for any regulations, lenders could sell exotic mortgages to home owners and traders could sell toxic securities to investors, via misrepresentations and concealment of facts. Due to such practices the “Originate to Distribute” model, which was developed with the promise of managing risk, itself became a generator of risk.

Securitization: Under the conventional financial system model lenders are usually prudent not only in making loans but also in their recovery.

However securitization which was based on “Originate to Distribute” model reduced the lender’s incentive to be prudent in making and recovering loans.

This was primarily due to high demand of mortgaged-backed securities which were not only rated AAA by rating agencies but also offered attractive rates of return.

This model integrated the lenders, borrowers and the investors, with dependence mainly on the borrower’s ability to repay the committed amount.

The downward spiral begun when the borrowers started to default on their loans, leading to an immense reduction in prices of mortgaged-backed securities and the booking of huge losses by the financial institutions and investors.

Deregulatory Legislations: The prevailing regulatory laws such as the Gramm-Leach Bliley Act and the Commodity Futures Modernization Act proved to be ineffective in preventing financial institutions to engage in risky transactions.

Further as these laws relied mainly on self-regulation and robustness of market discipline, they neither restricted the quantum of investments made by different investors in mortgage-backed securities, nor effectively regulated the Rating agencies, which for their own benefits provided high credit ratings to risky securities.

With the objective of aiding low income borrowers the Government also forced banks to engage in imprudent mortgage schemes under schemes such as the Community Reinvestment Act.

Due to the attractiveness and quantum of investment, financing of mortgage loans also migrated outside the regulated banking system providing deposit insurance and soundness regulation, to shadow banking system.

Financial Innovations: With the objective of maximizing revenue, U.S financial institutions resorted to different financial innovations. In this regard the most important technique which the banks applied was the formation of off the books special purpose vehicles for the purpose of engaging in risky investments.

These special purpose vehicles allowed banks to make huge loans during the expansion period, but at the same time also created a contingent liability in the bank’s financial statements, leading to a reduction in overall bank’s creditworthiness and an inability on part of different stakeholders to understand the bank’s true financial position.

Further numerous accounting principles such as mark to market accounting also allowed the banks to inflate the footing of their balance sheets by revaluing the securities to its prevailing market values in contrast to their true substance.

However among all such financial innovations the most significant was the development of complex immature securities for which the market and different stakeholders including financial institutions, investors, traders and rating agencies were not yet ready, therefore when these securities came under stress the response of the market was backed more by panic instead of systematic risk management.

These complexity of these securities is also considered by many as the heart of the economic crisis as regulators had no clue as to what was going on, investors were unable to make judgments on the merits of investment and market risk of such investments was obscured.

Excessive Leverage: During the post 2000 period the rates of interest were low and there existed excessive capital which discouraged fixed income yield.

In order to compensate such phenomenon many investors utilized borrowed funds to maximize the return, which multiplied the impact of housing downturn.

Human Frailty: According to behavioral finance humans do not always make the most optimal decisions because they suffer from limited self-control and bounded rationality.

Due to such phenomenon regulators usually try to aid investor’s decision making by requiring companies to provide numerous disclosures.

Bad Computer Models: The models developed to deal with complex securities were not effective and efficient in managing the risk and returns related to these securities.

This was primarily due to the fact that the models relied mostly on few decades of data which did not provide conclusions regarding the preferred course of action to be adopted in varying circumstances.

2.2.2. World Studies

The effects of financial crisis of 2007-08 were felt the greatest in U.S and European countries.

The effects on U.S is apparent as the entire U.S market was involved in the activities leading to the crisis. But it is essential to understand the global impact of the financial crisis of 2007-08 and the global factors leading to such crisis.

Wall Street is considered as one of the most advanced market offering a wide array of securities, thus responding to the risk appetite and investment preferences of majority of stakeholders around the globe.

Such supply of securities attracted majority of the European small and large investors, including major corporations, primarily due to the fact that the prevailing regulations in European countries did not allow financial institutions to make such risky investments.

Further some of the major banks such as Barclays was immensely involved during the peak of crisis by being interested in acquiring or investing in American banks under severe stress.

On the other hand majority of the Asian and Middle Eastern countries including Pakistan did not contribute much to the crisis as the financial markets in these countries are not as developed as those in America or European countries.

3. Methodology of Research

3.1. Research Approach

As aforementioned a quantitative approach has been adopted for the research under consideration. For this purpose quantitative data for United States has been derived for the selected variables with the objective of analyzing the causes of the financial crisis of 2007-08.

Despite for the fact that the financial crisis depended on certain other qualitative attributes such as the behavior of different stakeholders, reliance is placed primarily on the relationship between the selected variables for the purpose of drawing a conclusion and provision of recommendations.

3.2. Model Specification

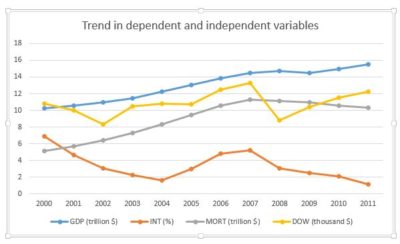

The model developed for the research is based on four different variables namely Gross Domestic variables at current U.S dollar values, real historical interest rate of U.S, all sector home mortgage asset levels and the Dow Jones Industrial Averages.

The dependent variable is the Gross Domestic Product while the remaining are used as independent variables, for the purpose of determining the effects of independent variables on dependent variable.

The model utilizes historical values of the aforementioned variables from the year 2000 to 2011, thereby forming 12 observations for each data set. The model specified for the research is as follows.

GDP = B0 + B1INT + B2MORT + B3DOW + u

3.3. Variable Description and Data Collection

The attributes and the source of data for the aforementioned variables is depicted in the following table.

| Variable | Attribute | Unit of Measurement | Source of data | Symbol | Nature |

| Gross Domestic Product | GDP of United States at current U.S dollar values | Trillions of USD | World Bank | GDP | Market value of all goods and services produced per annum by United States. Used as proxy for determining the financial crisis. |

| Interest Rates | Real Interest Rate per annum of United States | Percentage | World Bank | INT | Interest rate after adjusting for inflation. |

| Mortgage | All sector home mortgages level | Trillions of USD | World Bank | MORT | Loan provided by financial institutions while putting a lien on property being mortgaged. |

| Dow Jones | United States stock market index | Price in USD | Yahoo Finance | DOW | Stock market value of 30 large companies in United States. |

3.4. Econometric Technique

The relationship between the aforementioned variables has been analyzed using EViews software, where the variables has been described on the basis of research model specified above.

For the purpose of analyzing the relationship the aid of descriptive statistics for individual variables and equation function using the method of least squares has been obtained

3.5. Diagnostic Tests

Descriptive statistics and equations function has produced different nature of outputs for the data under considerations.

However for the purpose of analysis, Jarque-Bera and Probability has been interpreted for each variable under descriptive statistics, whereas Coefficient values, t-Statistic values and Probability values have been interpreted under least squared equation.

Further the null hypothesis for the research states that “The independent variables has no effect on the dependent variable”.

4. Findings and Results

4.1. Descriptive Statistics

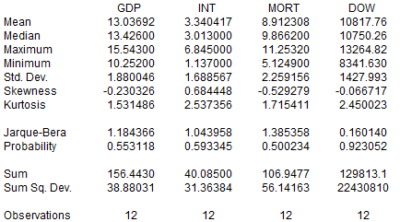

Following results have been drawn from the utilization of descriptive statistics technique.

The null hypothesis for Jarque-Bera test is that the data is normally distributed.

In this regard since the probability values of all the variables is greater than 0.05, we cannot reject the null hypothesis.

Accordingly we can conclude from the aforementioned table that the series of data for each of the variable taken for analysis is normally distributed.

4.2. Findings of Regression Analysis

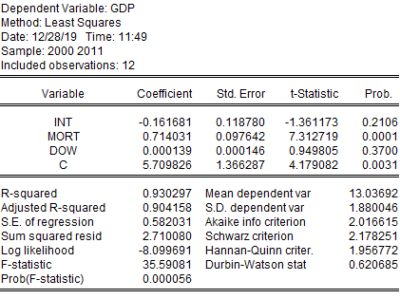

Following results have been drawn from the utilization of regression equation technique.

Interest Rate: There exist a negative relationship between real interest rate and GDP of United States. Accordingly  the coefficient value of -0.161681 indicates that with every decrease in rate of interest by 1% the GDP would increase by 0.161681 trillion dollars.

the coefficient value of -0.161681 indicates that with every decrease in rate of interest by 1% the GDP would increase by 0.161681 trillion dollars.

Since t-statistic value is greater than -1, there exist a significant relationship between real interest rate and GDP.

Moreover since the p-value is slightly greater than 0.2 there exist a slight chance of type-I error and null hypothesis cannot be rejected.

Mortgage Loans:

There exist a positive relationship between mortgage loans and GDP of United States.

Accordingly the coefficient value of 0.714031 indicates that with every increase in mortgage loans by 1 trillion dollars the GDP would increase by 0.714031 trillion dollars.

Since t-statistic value is greater than 1, there exist a significant relationship between mortgage loans and GDP.

Moreover since the p-value is less than 0.2 the chances of type-I error are insignificant and null hypothesis can be rejected.

Dow Jones Industrial Average:

There exist a positive relationship between Dow Jones Industrial Average and GDP of United States.

Accordingly the coefficient value of 0.000139 indicates that with every increase in Dow Jones Index by 1 dollar the GDP would increase by 0.000139 trillion dollars.

Since t-statistic value is less than 1, there exist an insignificant relationship between Dow Jones Industrial average and GDP of U.S.

Moreover since the p-value is greater than 0.2 there exist a chance of type-I error and null hypothesis cannot be rejected.

4.3. Results of Diagnostic Test

From the aforementioned diagnostic tests it can be deduced that the GDP of United States of America, which is used as a proxy for financial crisis of 2007-08 depends significantly on the level of housing mortgage loan provided by different financial institutions to different categories of consumers.

as a proxy for financial crisis of 2007-08 depends significantly on the level of housing mortgage loan provided by different financial institutions to different categories of consumers.

However such specific relationship of GDP with the real rate of interest and Dow Jones industrial average is not apparent.

5. Conclusion and Recommendation

5.1. Conclusion

The financial crisis of 2007-08 is considered as one of the greatest recession of recent times, which adversely affected global economies by wiping out wealth, wiping out jobs and promoting unequitable distribution of wealth.

The phenomenon was not an isolated event, instead a result of long term ignorance and promotion of personal preferences on part of different stakeholders including the government, academics, financial institutions, regulatory authorities and the traders and investors.

There were many causes of such financial crisis, among which the provision of un-regulated housing mortgage loans has been found the number one culprit, hence the term “housing bubble” used to refer the crisis. Therefore it can be concluded that

- Long-term developments in financial market can be blamed for the financial crisis such as the variation in interest rates and the provision of excessive volume of housing mortgage loans.

- Derivatives and other financial risk management techniques actually increased the risk of economic instability by promoting financial innovations.

- The market performance was too much reliant on computer models and it seemed like everyone knew what they were doing and getting themselves involved into.

- Regulators and policy makers failed to prevent excessive risk taking by failing to develop laws and regulations capable of regulating the changing market variables.

- Government policies and actions inadvertently became the basis for different preconditions of financial crisis by allowing different institutions to take actions on their own accord. For example the government did not bailout Lehman Brother which was the first major victim of the crisis but for the purpose of managing any further adverse impacts of the crisis on the economy it was required to bailout the entire banking system of United States.

5.2. Recommendations

Following are some of the recommendations which seem pertinent in light of the conclusion drawn from the aforementioned research.

- Enhance the effectiveness and efficiency of legislations for different stakeholders by making them accountable for their actions.

- Look out for the introduction and trading of financially innovative securities and provide awareness among different stakeholders regarding the risk and rewards connected to them.

- Proactively look out for activities prevailing in the economy which might lead to economic downturns in the future.

- Develop reliable models which are adjustable in light of the changing variables.

5.3. Scope of Future Research

There exist extensive scope for future research with respect to the topic under consideration.

Among this the most significant area of study would be the study of causes of financial crisis from the qualitative point of view involving considerations such as behavioral finance and conflicts of personal and institutional interest.

Further reading: US Financial Crisis: Consequences and Policy Responses

COMMENTS